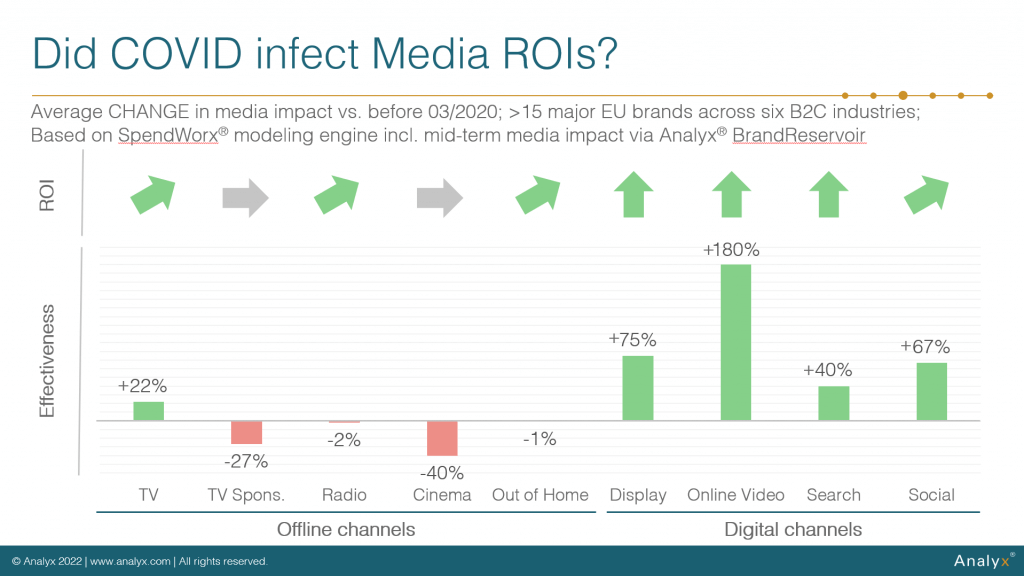

We crunched the numbers across >15 major European brands in six B2C industries and are proud to give you a teaser today:

The New Normal

Since mid-2020, CMOs are wondering how this infamous “new normal” will look like. There is lots of evidence already how consumer demand patterns have been changing as well as media consumption. Less clear is the impact on media effectiveness and ROI since a number of factors are at play in parallel, e.g.:

- Lockdowns mean less offline spend and less restaurant consumption (=less Return for some industries and categories, more for others)

- Higher media consumption means more exposure – but how about attention?

- Tighter media budgets mean heavy price declines for some media channels (=lower Investment)…

Quantitative Insights from >15 Brands

Analyx has been working as an independent service & technology provider with a lot of leading brands over the past 5+ years based on its SpendWorx® platform for agile marketing budget allocation. This allows us to take some insightful cross-industry conclusions:

A forthcoming study is based on dozens of advanced econometric models for >15 EU brands. Industries covered range from Retail via Food and non-Food CPG all the way to Financial Services (direct and traditional). Its focus is the CHANGE in media effectiveness and ROI by comparing a pre-COVID period with a period that includes the last 2 years of data. And since SpendWorx® is explicitly modeling the mid-term impact on sales via brand equity, this is not just limited to short-term impact.

The Key Findings

- There is no overall decline in effectiveness: Overall media effectiveness incl. brand effects even increased slightly by 5% for the brands covered

- 2020/21 saw a boost in digital effectiveness: We cannot determine if Covid CAUSED higher digital effectiveness or if it has been a mere catalyst. But especially online video has seen a dramatic increase compared to pre-Covid. This is certainly also driven by brands’ increasing sophistication in mastering online video creatives!

- ROI stayed flat or increased on average: Even though multiple offline channels such as cinema (understandably) saw heavy declines in media effectiveness, overall ROI did not decline in the same vein. So: Media ROI does not seem to have caught a cold!

- BUT: Variance between industries and brands is huge! Underneath these numbers the picture is not NEARLY as uniform. Categories and individual brands differ a lot both in their relative media effectiveness and also in the change vs. pre-Covid. There are lots more stories to tell in upcoming publications…stay tuned ?

Note: All findings shown on the chart above are averages across the modeled brands and refer to CHANGES in effectiveness and ROI. The chart says nothing about the actual effectiveness or ROI of these channels.

Does this match your own experience over the last 2 years?

Please share your thoughts and comments…